2022 wasn’t the year of Solana DeFi indeed. After the collapse of FTX and Alameda liquidity drying up, SOL price has collapsed and attractive yields have left the room. However, hope came from an unexpected quarter, NFT investors. Thanks to low tx fees and a strong community Solana became the second most popular chain for NFTs.

Some view this as an opportunity for Solana DeFi to return from the dead with fresh users and liquidity. But these users are very different. We refer to them as JPEG people and try to find to what extent they utilize Solana DeFi. It's pretty obvious they don't use many DeFi platforms, but we wanna investigate to what extent and what exactly they do. Let’s find out.

Methodology (boring 👀)

First, we got a list of unique NFT users (addresses) from the NFT sales db. Further analysis was based on the Solana events (transactions) of these users. We didn't need to take into account the specifics of different contracts since we've been counting unique interactions.

We adjusted protocol labels provided by the Flipside team manually to exclude NFT-related DeFi apps. We also used the fact swaps table to calculate the swap volumes of NFT users.

Solana JPEG People

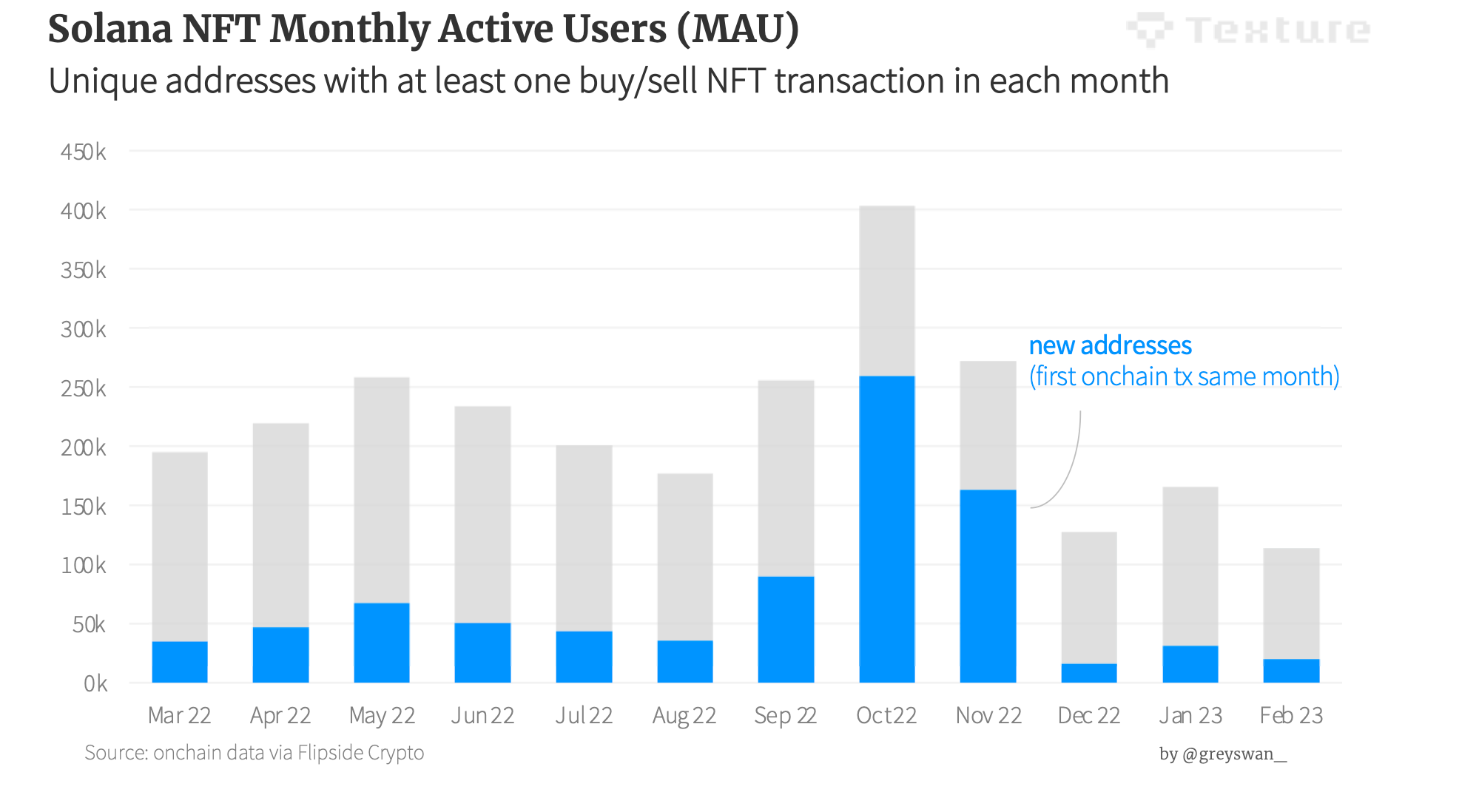

Let’s take a look at the population of Solana JPEG people first. How to define them? We use MAU (‘Monthly Active Users’), unique addresses which bought or sold an NFT that month.

New addresses account for >50% of active NFT users in October-November 2022, big inflow of new users is a likely explanation. Another partial explanation for such increase in new users could be an increase in wash trading. In October 2022 Magic Eden removed fees and made royalties optional making wash trading easier. Although, we haven’t dug into that and are not sure if wash trading guys need to create tens of thousands of new accounts (that scale would affect our findings). That might be adding some distortion to the results, but the trends we found look robust (more on NFT wash trading)

Anyway, we aren’t trying to figure out how JPEG people arrive to Solana, but rather what they do.

JPEG People vs DeFi

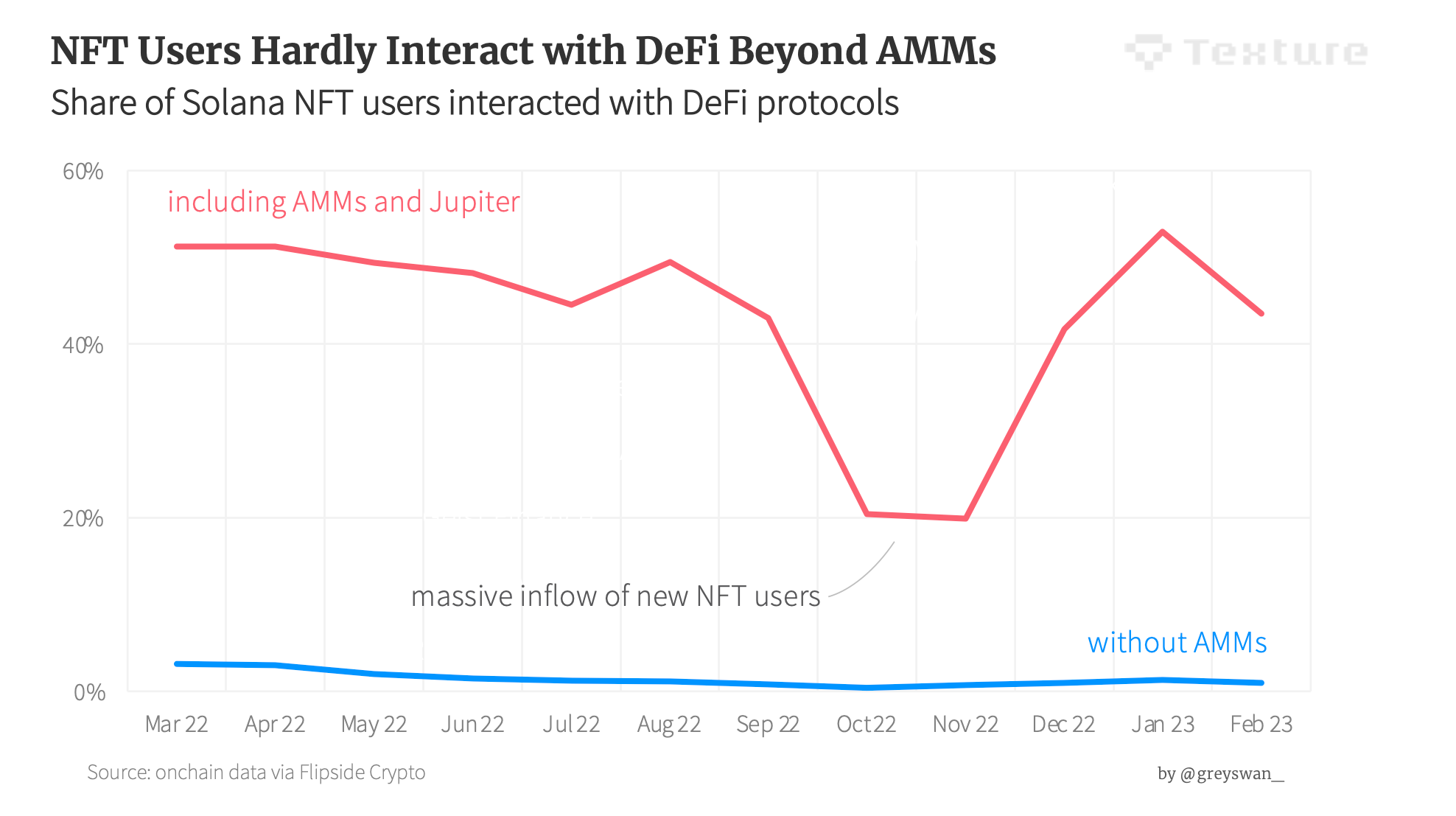

It makes sense to treat AMMs and trading aggregators (Jupiter) differently from other DeFi apps and you can see why. Around half of the JPEG people population used DeFi in general (including swaps) at least once almost every month, however, if we exclude AMMs, the current adoption is only ~1%. Likely FTX meltdown and the massive arrival of new JPEG people to the chain caused a surge in DeFi interactions last autumn.

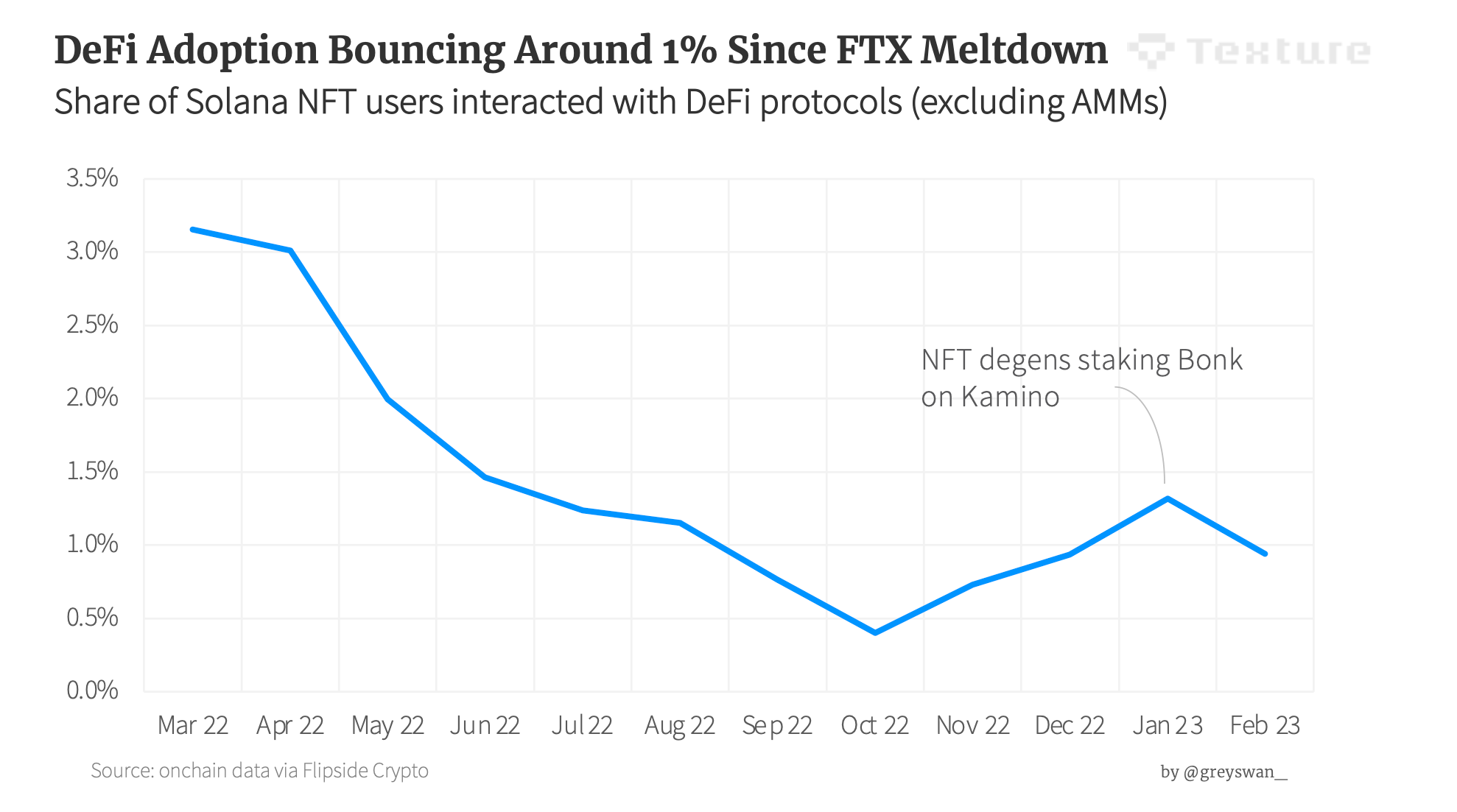

Looking at the DeFi apps excludings AMMs separately adds some dynamics too: maximum adoption in March 2022, the time of juicy yields and degen farmers, the brave world where Terra, FTX, and many others were still with us. These yields had vanished since and many new JPEG people have come to Solana (first chart with user numbers). The January 2023 increase in adoption deserves some attention: an earlier airdrop of Bonk token had its effect - some NFT users were utilizing DeFi to stake it. Many of them used Kamino, as you will see later.

What’s DeFi here?

We don’t include NFT FI services such as Frakt, Sharky, Rain, etc (these guys are fine btw) since we wanna see an intersection between JPEG people and ‘traditional’ DeFi. We manually adjusted Flipside labels for that.

What about those who staked through AMMs directly?

This chart is missing users who staked directly with Orca and other AMMs (there likely were some) since AMMs are excluded, sorry about that.

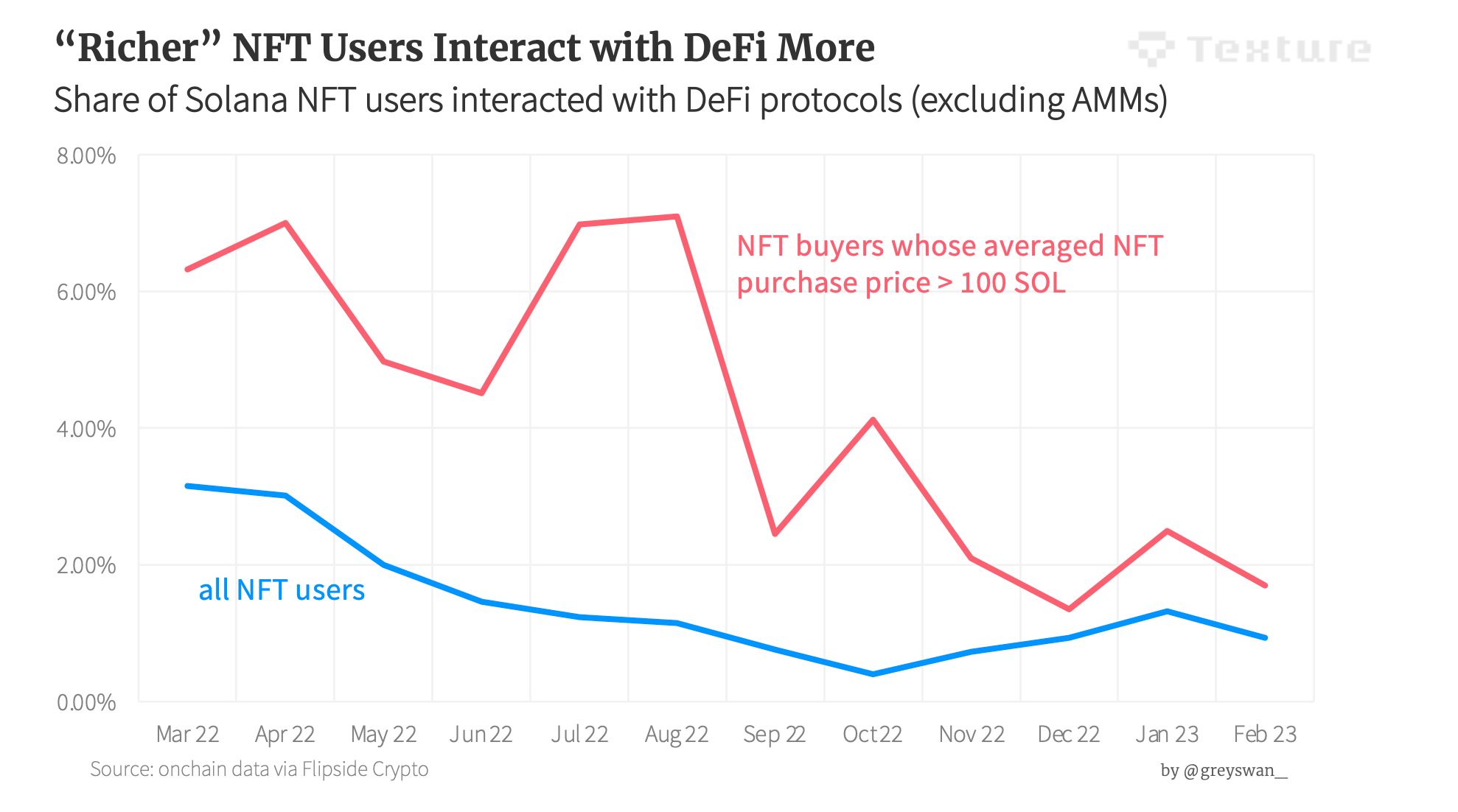

Not all NFT people are the same, if we look at the “richer” ones using a threshold of average JPEG buy size >100 SOL, they look savvier (at least used to be).

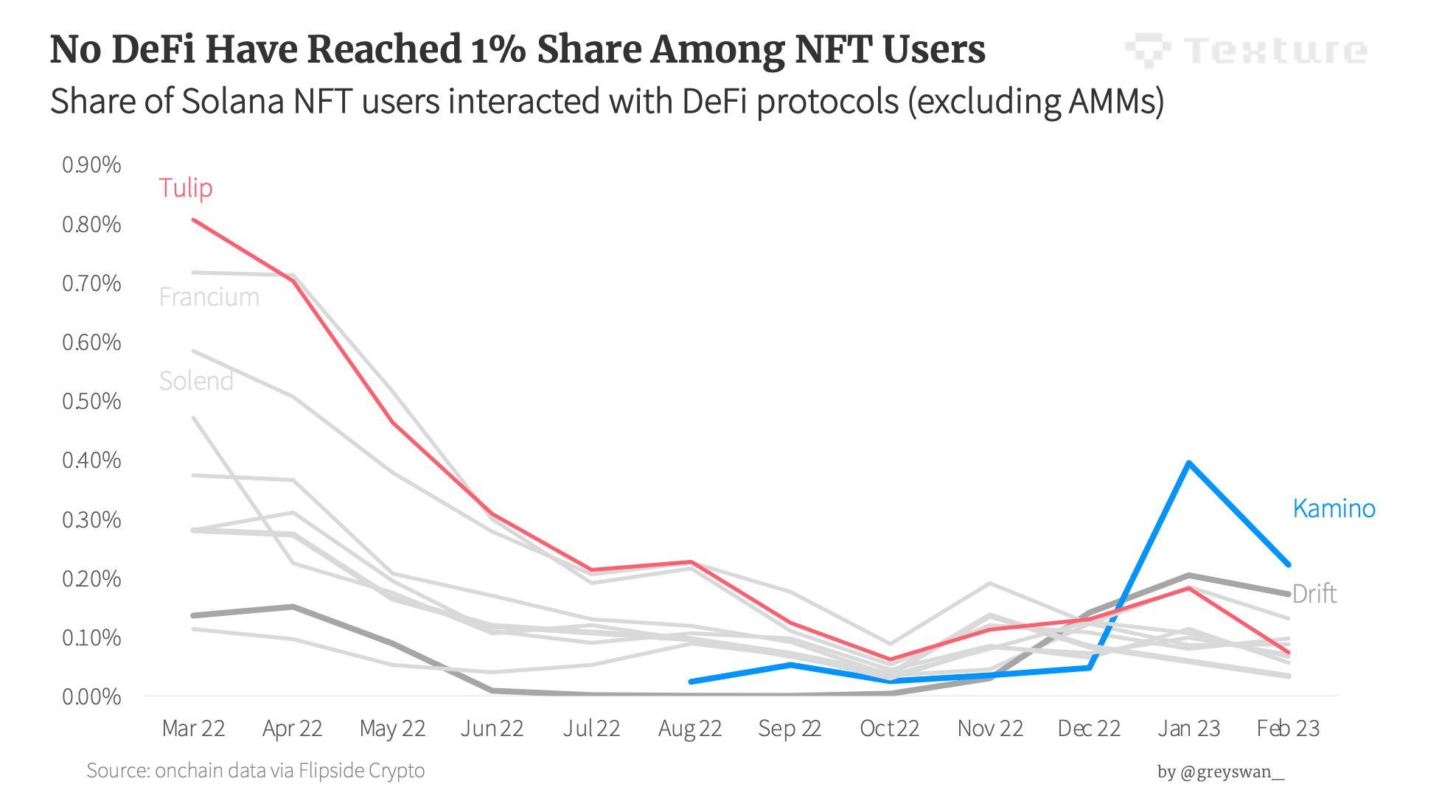

The protocol-level picture shows the same trend. With juicy yields and token rewards Francium, Tulip and Solend were leading the charge, and now Kamino (staking Bonk?) and Drift (Bonk perps with leverage?) are capturing the declining JPEG people’s attention towards DeFi.

How this was calculated?

For this chart, we analyzed the intersection between each protocol and NFT users separately. That means the same user can be included in the several protocol shares if the same user used several protocols that month.

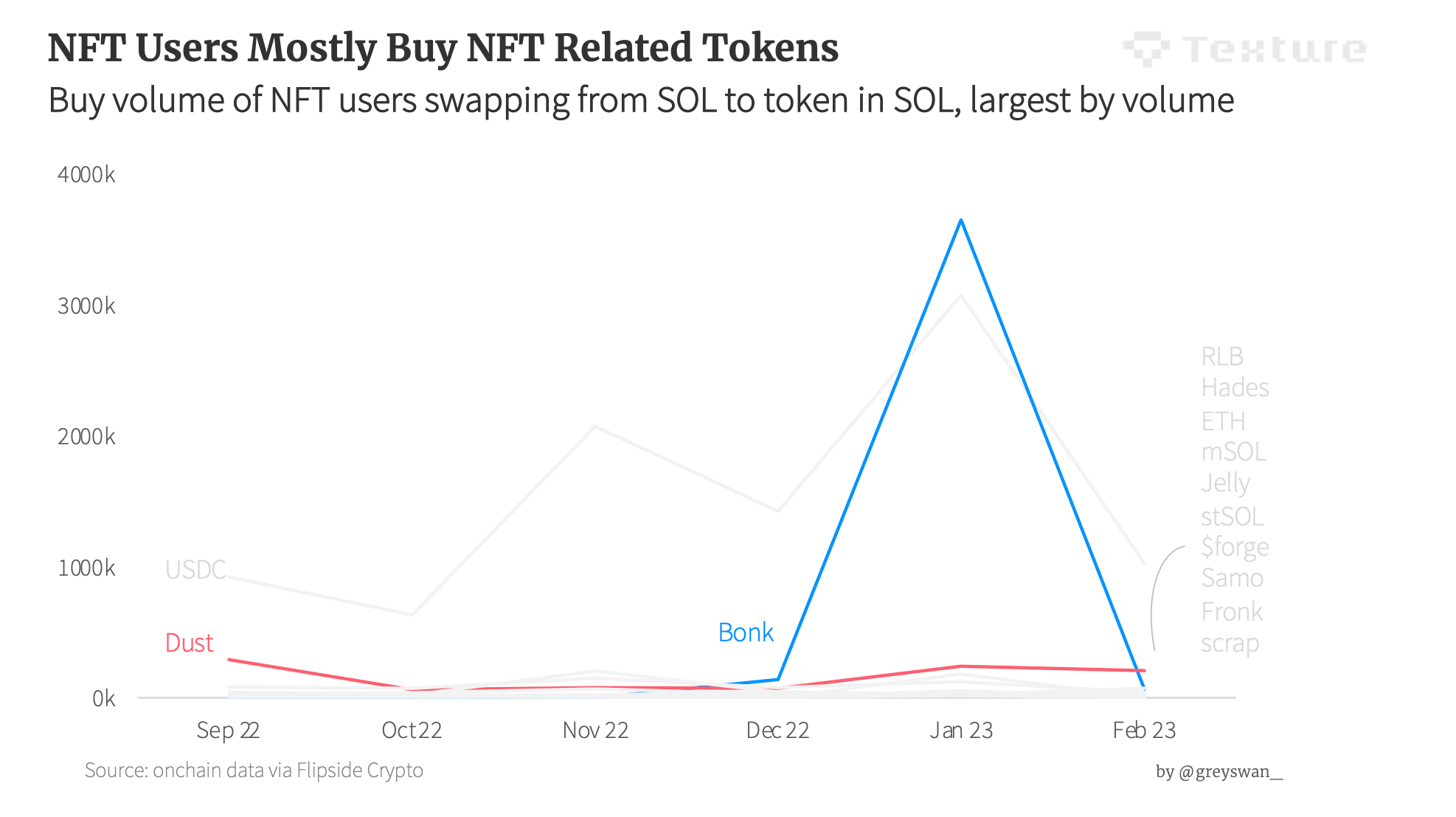

What do they swap?

As we showed earlier, these guys swap a lot. However, that’s not the type of trading you expect a proper DeFi degen to do. Most of the fungible tokens (except for stables and SOL LSDs) that JPEG people are trading are NFT-related. It’s more like a derivative of their core NFT speculation activity. BONK, Hades, DUST, you name it.

How different from Ethereum?

Remarkably, that is very close to ElBarto's findings on Ethereum: less than 1% of NFT users there tried borrow/lending, which is equivalent to what we view as DeFi (excluding AMMs) on Solana above.

"Dex Trade" actually tends to be the lowest form of DeFi "friction."

— ElBarto_Crypto (@ElBarto_Crypto) January 21, 2023

-While about 1/3rd of NFT buyers made a DEX trade, only 13% transferred USDC/USDT (thought that would be higher) and less than 1% made a "borrow" action (3/n) pic.twitter.com/dAfhgO11Vn

So what?

These users are just different, and even the population of JPEG people on Solana has changed a lot since the time of juicy yields in early 2022 (chart at the beginning). They are not the good old degens we’ve been used to since the last bull market. Many may not be aware of DeFi.

11/ Even anecdotally here in Hong Kong, the sheer number of people I've met who were onboarded onto crypto via NFTs but have no idea what Ethereum is (most interactions were on @solana) was telling to me

— Jason Choi (@mrjasonchoi) February 7, 2023

The apps are what control onboarding, mindshare; block space is a commodity

These days JPEG people use traditional DeFi only to swap NFT-related tokens, convert SOL to stables, or stake some spare BONK. Now it would be naive to assume as many do that this clientele could be converted into proper DeFi degens at some point. New protocols at the intersection of DeFi and NFT which cater to this crowd continue to emerge and grow their TVL.

If the next bull market comes to Solana we may see more of these guys exploring ‘traditional’ DeFi for decent yields, but…