Leveraged staking is a DeFi strategy to maximize yield, basically looping your liquidity through several protocols, staking your tokens somewhere to mint LP tokens or stablecoins, and then depositing it with lending protocol to borrow more and repeat. Liquid staking tokens (i.e. stETH, stSOL and others) are a popular base asset for leveraged staking as they provide native yield and are correlated with an underlying asset (i.e. ETH or SOL).

How does leveraged SOL staking exactly work?

- Deposit SOL to Lido and get stSOL

- Deposit stSOL to Solend

- Borrow SOL on Solend using stSOL as collateral

- Stake borrowed SOL with Lido again and repeat all steps above until you reach the loan-to-value ratio you want

- Don’t forget to claim your rewards and reinvest

Leveraged staking strategies can provide returns well above the yield from vanilla staking of ETH or SOL with Lido. Although such a strategy may look almost risk-free at first glance as you borrow against a correlated asset, it's not.

Leveraged Staking Strategy Risks

1. Depeg of stETH, stSOL / mSOL (for Solana), the depeg may happen because of a liquid staking protocol malfunction or hack. Panic sell pressure, liquidity constraints and limited redemption options can cause a depeg. The 3AC fund collapse which held a large chunk of stETH is a good example here.

2. Oracle bug. Lending protocols rely on the price provided by oracles when handling liquidations. Sometimes oracles can get funky and sudden price swings there cause unnecessary liquidations as witnessed on Solend with Pyth in January 2022.

3. Deposit rates decrease (or borrow rates increase). Decreasing token rewards and high lending rates can make your leveraged position yield negative. It’s not catastrophic but rather annoying, as you have to unwind leverage and if done manually it is inconvenient.

Instadapp and DeFi Saver offer automated leveraged staking as a product on Ethereum, and Instadapp alone, having shown its worth, attracted over $600m TVL at its peak in May this year. Although their current TVL is much lower these days, not lastly because of the bearish market sentiment combined with the fact that currently ETH can’t be redeemed from staking even though Ethereum has switched to Proof-of-Stake. In fact, stETH is still traded at a discount to ETH (as of 19/10/2022), making leveraged strategies riskier and less attractive.

Therefore if you are looking for staking yield above the market rate without going 100% degen you should consider other PoS chains and Solana seems to be a decent option.

Leveraged Staking on Solana: More Than You May Think

In the case of Solana, a leveraged staking position on Solend (the largest lending protocol on Solana) is SOL borrowed against stSOL (or Marinade’s mSOL) collateral, SOL and stSOL. Given that Solana is Proof-of-Stake since its launch and it allows withdrawals from staking, leveraged staking plays a major role in DeFi strategies on Solana and its TVL buildup.

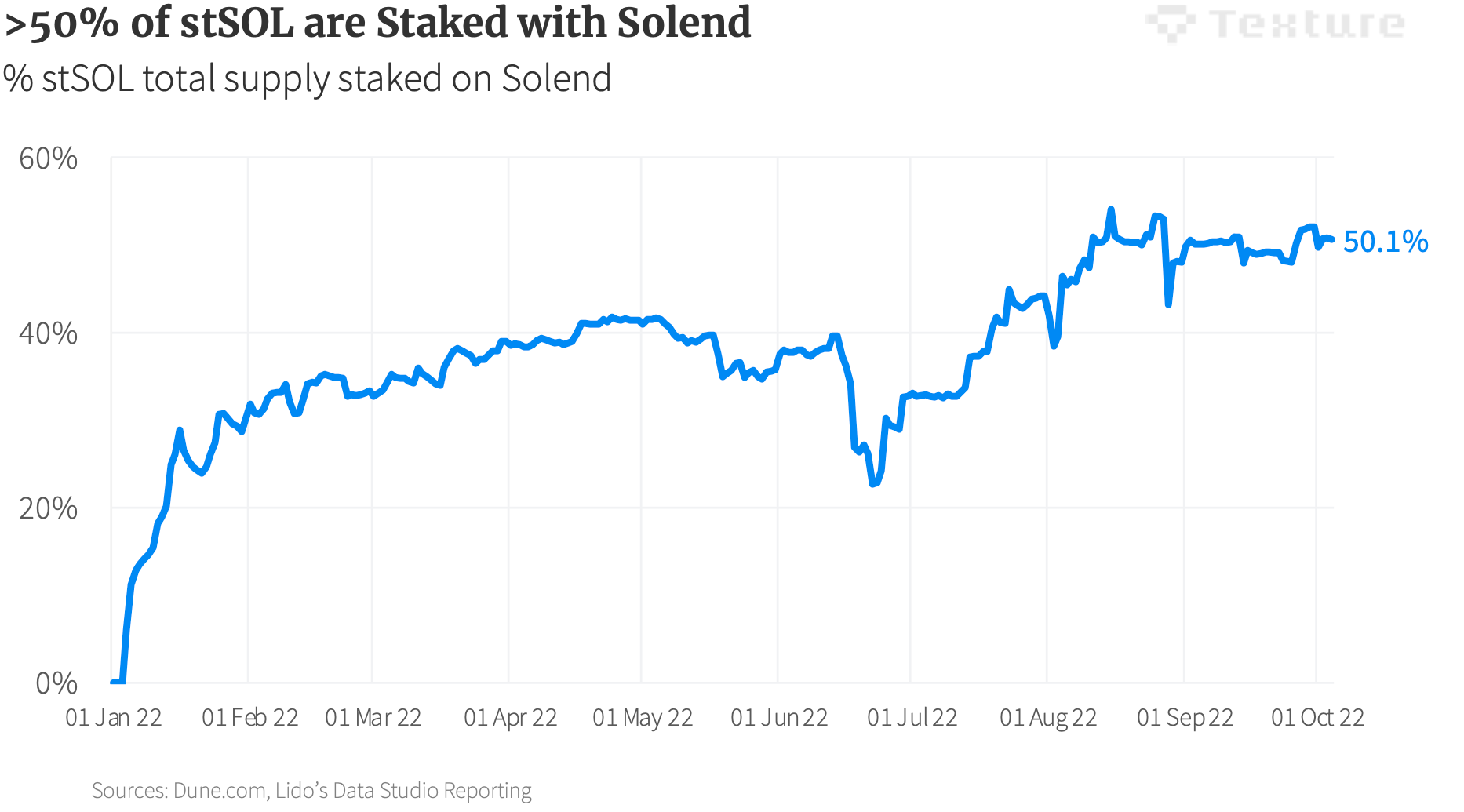

When looking at the share of stSOL total supply staked in Solend, it’s fair to assume that the significant bulk of it relates to leveraged staking.

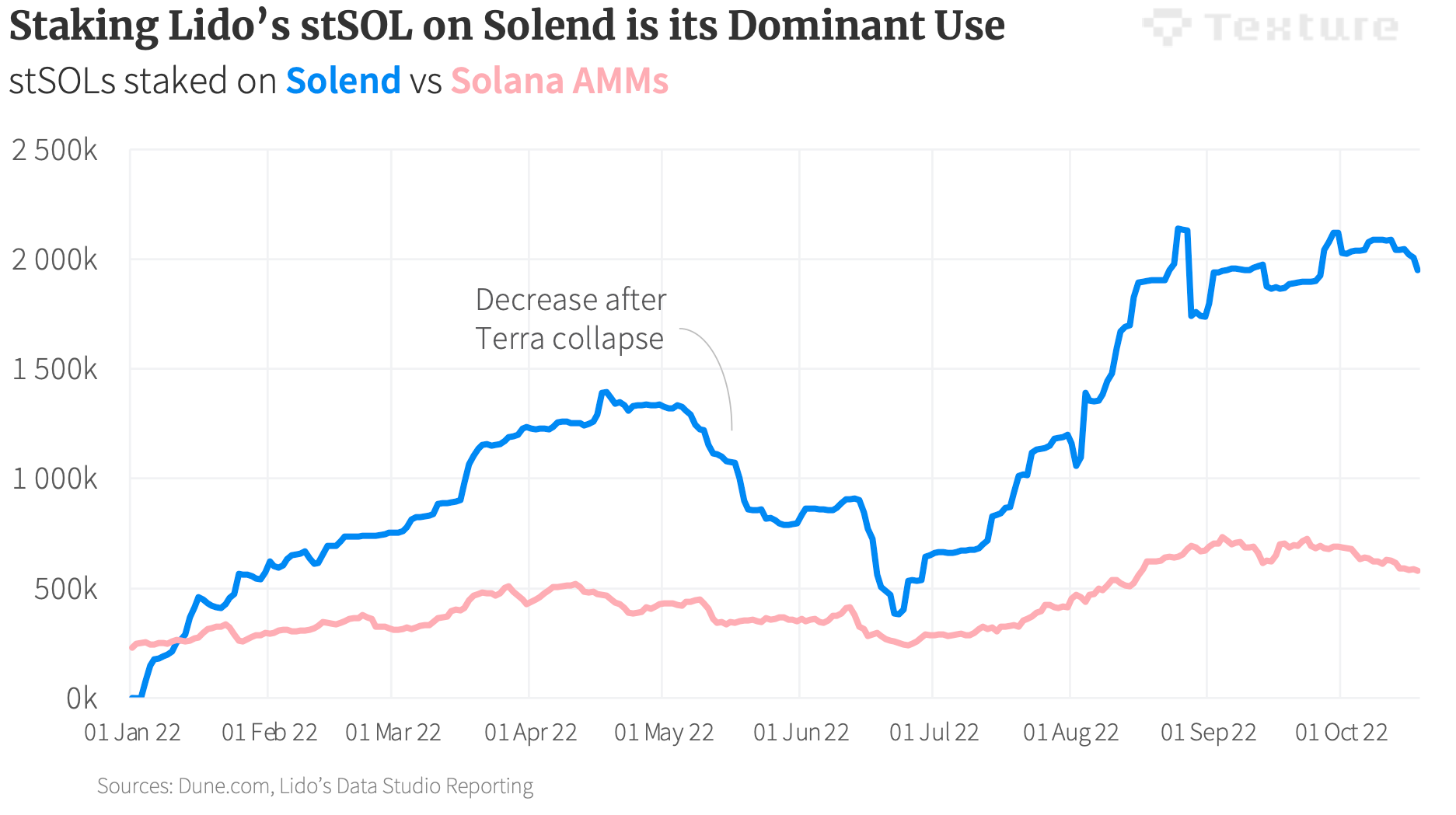

The number of stSOL tokens staked in Solend compared to what’s been staked in the AMMs indicates the growing popularity of the strategy. The “steps” on the Solend line in the chart below indicate that most of these stakers are rather large investors, inflows and outflows happen in big bulks.

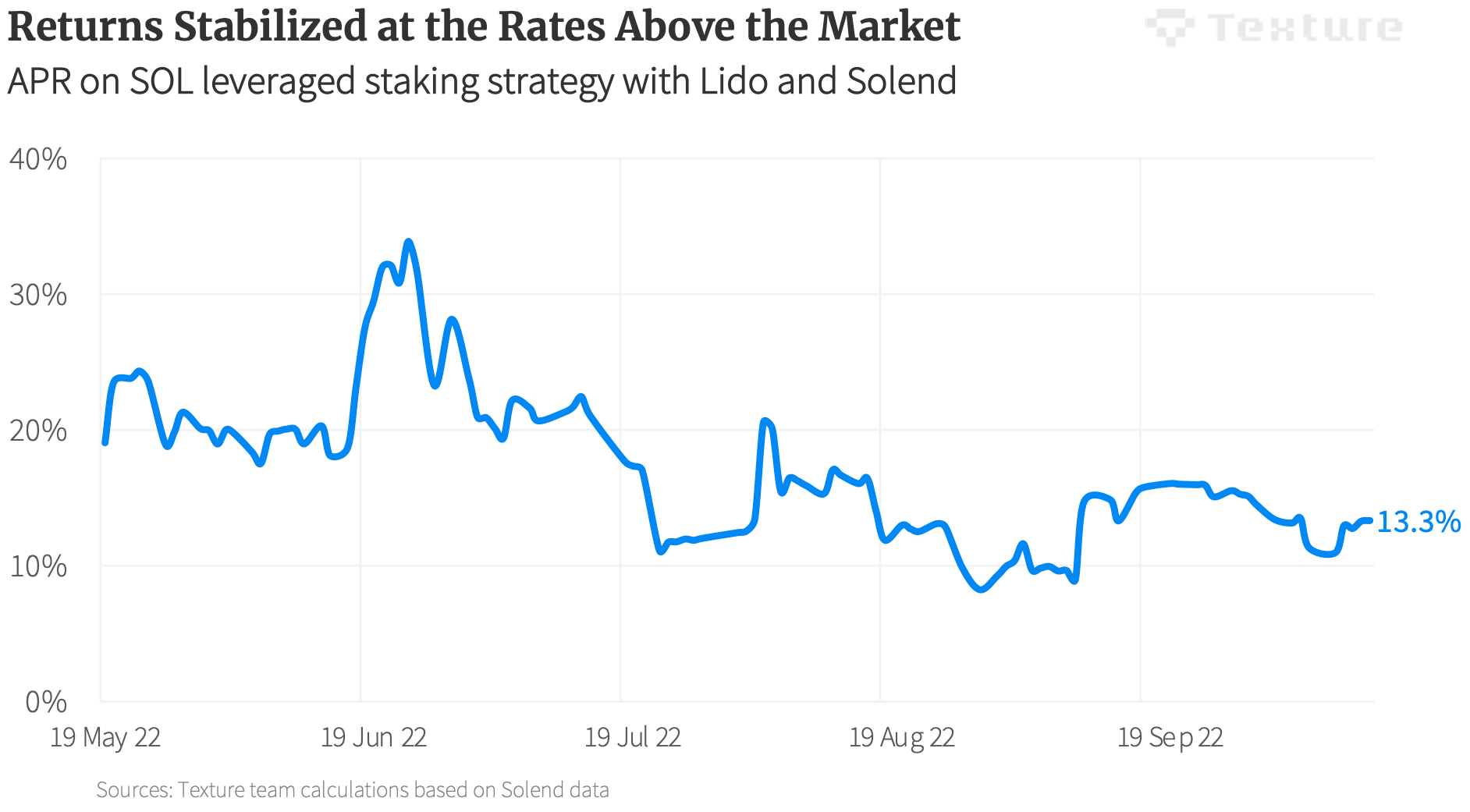

Returns from leveraged staking on Solana have been volatile, but they stabilized around 10%-15% APR, while Lido liquid staking currently gives only 5.5% on your SOL.

How historical APRs were calculated?

The historical APRs are indicative and may not reflect the real ones as Solend pays rewards monthly and rewarded tokens’ prices fluctuate between reward periods. Rewards and supply APYs data have been manually collected daily from the Solend UI, some data points were missing and therefore averaging was applied.

What does Texture have to do with leverage staking? Automate it!

Transparent 10-15% returns from leveraged staking on your SOL look attractive, although running such a strategy involves lots of hassle. You would have to monitor loan-to-value ratios and Solend rates as well as rewards. Unwinding would also be annoying. In the absence of fully functional flash loans on Solana, you would swap stSOL on AMMs in small instalments to slowly decrease LTV.

Texture solves this with its first product. One-click leveraged staking to get automated yield with built-in onchain risk management and automated unwinding.

Check out the first demo showing how the protocol backend works and subscribe to Texture’s Twitter and join our Discord.

1) One-click leveraged staking is finally coming to @solana. @texture_fi stakes your SOL on @LidoFinance and leverages it on @solendprotocol to boost your real yield to ~15% while managing LTV and autocompounding token rewards. This video shows how we monitor the protocol metrics pic.twitter.com/4z67C2BtiT

— Texture Finance (@texture_fi) October 17, 2022